Orthodontists create beautiful smiles by improving patients’ oral health. But beyond the professional satisfaction, what kind of financial picture can you expect? Let’s delve into the world of orthodontist salaries in the USA

This article explores the Orthodontists wages in United States Of America, exploring the factors that influence your earning potential and offering tips to maximize Orthodontists income in this dynamic field.

Defining the Orthodontists:

Orthodontists are dental specialists who help patients to correcting misaligned teeth and jaws. They are experts at using a variety of fixed and removable appliances like braces, clear aligners, retainers, headgear, and more.

Common conditions and problems that orthodontists treat include:

- Overcrowded or overlapping teeth

- Excessive spacing between teeth

- Underbite, overbite, crossbite

- Jaw growth problems

- Improperly erupted teeth

Orthodontists Salary Range

According to the U.S. Bureau of Labor Statistics1, the annual median salary for Orthodontists is $239,200 or more. Orthodontists earn salaries ranging from $89,980 to $239,200 or more annually.

Top 10% earners: Exceed $239,200 annually

Bottom 10% earners: Make less than $89,980 annually

Projected annual median salary for Orthodontists in 2024-2025 (with 2.5% increase) is $245,180 or more.

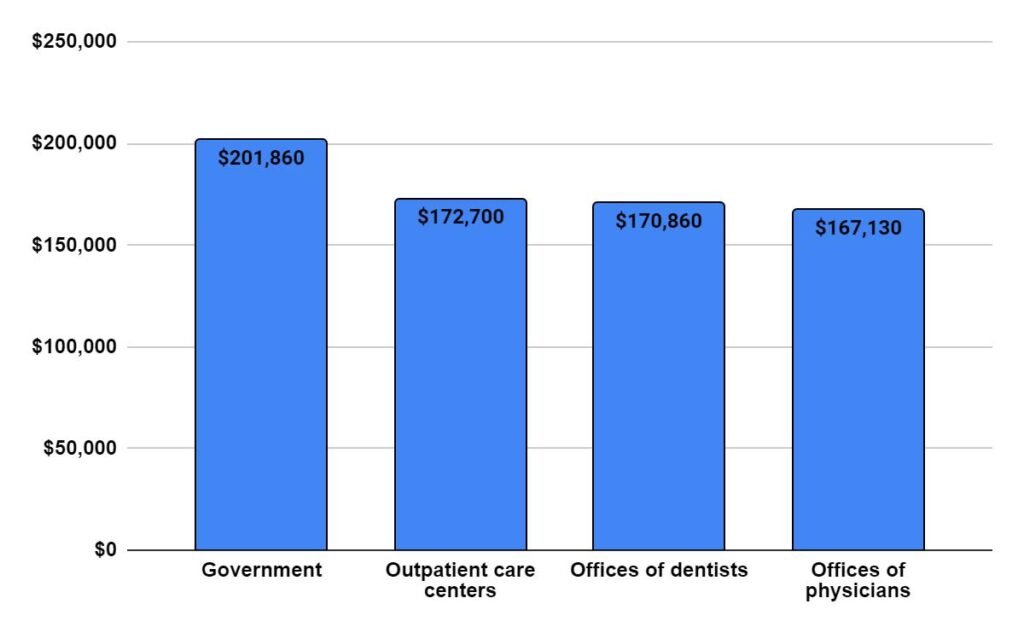

The median annual wages for Orthodontists in the Top industries

Chart 1: Median annual wages for Orthodontists in the top industries (U.S. BLS May 20232)

This wide range highlights the diverse factors that influence a Orthodontists income in USA. We will be discussing those factors below.

Top Paying Industries for Orthodontists

The U.S. Bureau of Labor Statistics (BLS) data reveals that Orthodontists working for Offices of Dentists earn the highest annual salaries, exceeding $ 246,000 annually (U.S BLS May 20233).

Other high-paying industries in USA includes General Medical and Surgical Hospitals.

| Industry | Hourly mean wage | Annual mean wage |

| Offices of Dentists | $ 118.72 | $ 246,950 |

| General Medical and Surgical Hospitals | $ 87.78 | $ 182,580 |

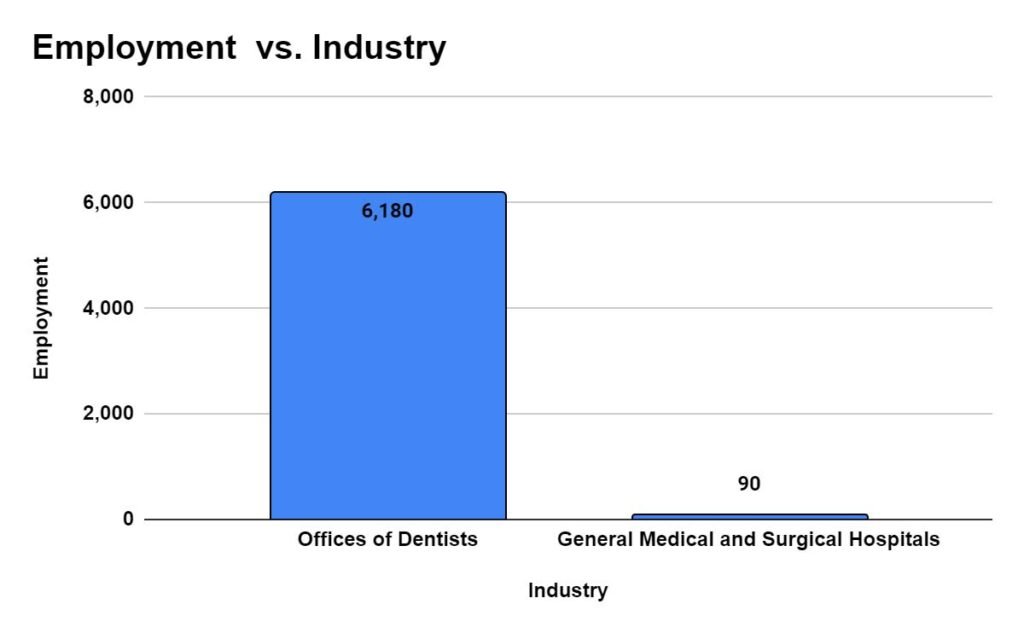

Industry with highest Employment Level for Orthodontists

Most number of Orthodontists are employed in Offices of Dentists, followed by General Medical and Surgical Hospitals.

Chart 2: Industry with highest employment level for Orthodontists

Top Paying U.S. States for Orthodontists

North Carolina leads the pack with the highest annual mean wage for Orthodontists in USA. Following closely are Michigan and Florida all offering wages exceeding $239,200 annually (U.S BLS4).

| State | Hourly mean wage | Annual mean wage |

| North Carolina | ≥ $115 | ≥ $239,200 |

| Michigan | $ 158.47 | $ 329,620 |

| Florida | $ 155.30 | $ 323,030 |

| Connecticut | $ 154.09 | $ 320,500 |

| Pennsylvania | $ 142.23 | $ 295,850 |

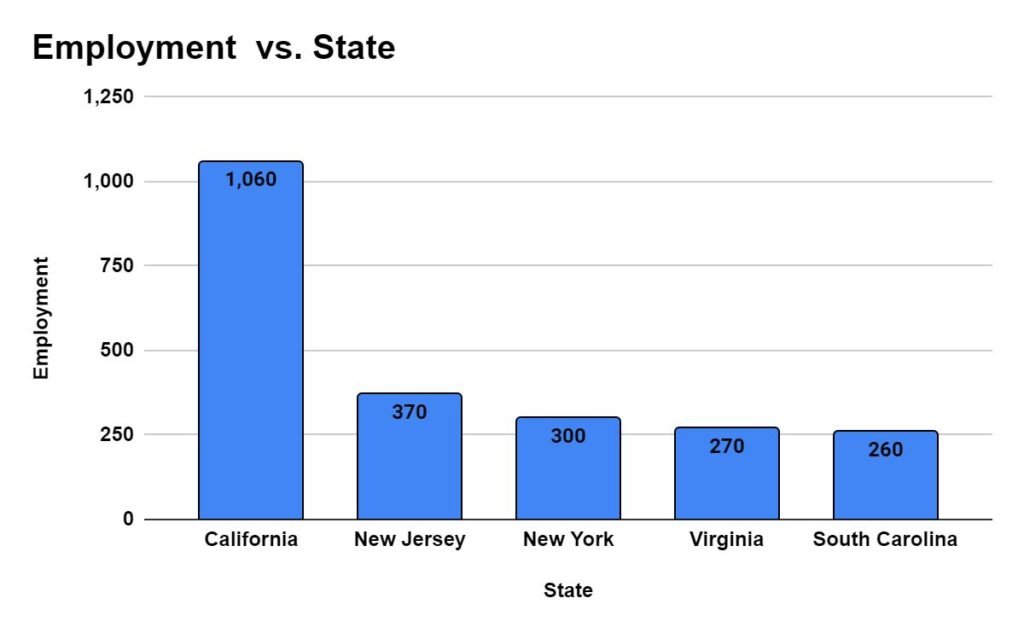

Click Here To View Wages of All States U.S. States with the highest employment level for Orthodontists California leads in providing employment to the Orthodontists, followed by New Jersey and New York. Chart 3: States with the highest employment level for Orthodontists After factoring in federal and state taxes, a Orthodontists with a state-wise annual mean salary, would have an estimated net income as follows: Taxes and take home pay estimate for a single filer New-York: $228,010 (Annual mean wage) – $60,605 (Estimated income tax) = $167,405 (Estimated take home pay). California: $208,470 (Annual mean wage) –$56,754 (Estimated income tax) = $151,716 (Estimated take home pay). South Carolina: $149,660 (Annual mean wage) – $34,416 (Estimated income tax) = $115,244 (Estimated take home pay). More taxes can be saved by contributions in IRA, retirement, itemized deduction such as charitable contributions, medical and dental expenses. The average annual expenses for a single person household in New York are estimated at $46,584 excluding taxes, according to estimates from the Massachusetts Institute of Technology5. (The figures are measured in 2023 inflation-adjusted dollars) Based on this estimate, a Orthodontists earning the take home pay of $167,405, with basic expenses could potentially save $120,821 annually. It’s important to note that individual expenses can vary significantly depending on lifestyle choices and location. Savings for Married Couples/Households: While the data provided doesn’t explicitly detail salary savings for married couples or households, it’s important to consider that combined incomes and potentially shared expenses could significantly increase overall savings potential in USA. Total compensation for Orthodontists goes beyond the hourly or annual wage. Organizations offer additional benefits such as: Housing stipends: Provides financial support for housing during your placement. Meal stipends: To help with daily meals. Travel allowances: To reimburse travel expenses incurred during relocation. Health insurance: Comprehensive health insurance coverage for you and your dependents. Paid time off: Vacation days and sick leave. Childcare assistance: Childcare assistance programs help employees manage this significant expense. Life insurance: This benefit provides financial protection for an employees family in the event of their death. Disability insurance: This benefit provides income to an employee who is unable to work due to a disability. Continuing education reimbursement: Support for professional development and training. Retirement savings plans: Retirement planning gets a helping hand with employer-sponsored plans like 401(k)s. These plans offer tax advantages for saving. Employers may also match employee contributions. Several factors can affect Orthodontists paycheck: Experience: As with most professions, experience plays a significant role in determining salary. Entry-level specialists can expect lower salaries, while seasoned professionals with proven track records command higher compensation. Specialization: Those who specialize in services like lingual braces, clear aligner therapy, or jaw surgery may be able to charge more. Location: Geographic location significantly impacts Orthodontists salaries. U.S. States like North Carolina, Michigan, and Florida offer some of the highest pay, while others may offer lower wages. Industry: The industry you work in can impact your salary. Offices of Dentists offer the highest wages. Employer: Orthodontists who own their practices tend to earn more than those who are employed by others. Contract Details: The specific terms of the employment contract, including factors like housing stipends, overtime pay, and benefits, can affect the overall compensation package. So, how can Orthodontists maximize their salary? Here are some tips: Skills and Certifications: Pursue specialty certifications like board certification and practice skills like interpersonal skills, and marketing skills and expertise in clinical and technical skills, all these are essential for a successful, profitable practice. Negotiate Your Salary: Don’t be afraid to negotiate your salary during the job offer stage. Research market rates for Orthodontists with your experience and qualifications. Building a Strong Reputation: Building a strong reputation for excellent patient care and achieving successful treatment outcomes can attract referrals and help you grow your practice. Continue Learning: Stay up-to-date with the latest advancements in your field by attending conferences and pursuing training opportunities. Conclusion: A career as a Orthodontists in United States offers both professional satisfaction and the potential for a high salary. By understanding the various factors that influence salary and carefully managing expenses, Orthodontists can make informed decisions and pave the way for a rewarding and financially secure career path. Share this Post The world of accounting offers a stable and rewarding career path. But for aspiring accountants… Note: This article provides general information only and should not be considered financial advice: Your individual circumstances and specific job offer details will significantly impact your actual earnings. Seek professional guidance: Consulting with a financial advisor can provide personalized advice on managing your finances and maximizing your savings potential. ResourcesArea name Employment Hourly mean wage Annual mean wage Alabama (al) 150 131.69 273910 Arizona (az) Estimate not released by U.S. BLS. 72.38 150550 California (ca) 1060 100.23 208470 Connecticut (ct) 100 154.09 320500 Florida (fl) Estimate not released by U.S. BLS. 155.30 323030 Indiana (in) 150 81.54 169610 Maine (me) 120 79.18 164700 Michigan (mi) 210 158.47 329620 New Jersey (nj) 370 Estimate not released by U.S. BLS. Estimate not released by U.S. BLS. New York (ny) 300 109.62 228010 North Carolina (nc) 180 ≥ $115 ≥ $239,200 Ohio (oh) 180 114.48 238120 Oregon (or) 170 Estimate not released by U.S. BLS. Estimate not released by U.S. BLS. Pennsylvania (pa) Estimate not released by U.S. BLS. 142.23 295850 South Carolina (sc) 260 71.95 149660 Texas (tx) 170 Estimate not released by U.S. BLS. Estimate not released by U.S. BLS. Utah (ut) 90 60.56 125960 Virginia (va) 270 Estimate not released by U.S. BLS. Estimate not released by U.S. BLS. Washington (wa) 120 141.79 294920 Wisconsin (wi) 60 120.08 249760

Orthodontists Take-Home Pay

Expenses and Savings Potential Estimates in USA

Beyond the Base Salary

Factors Affecting Orthodontists Income

Boosting Orthodontists Salary: Skills and Tips

Financial Risk Specialists Salaries USA 2024: States and Industry

Loan Officer Salaries USA 2024: States and Industry

Financial and Investment Analysts Salaries USA, 2024 Trends

Accountants and Auditors Salaries USA 2024: States and Industry