The world of accounting offers a stable and rewarding career path. But for aspiring accountants and auditors a crucial question often arises, how much can accountants and auditors expect to earn in the USA?

This article delves into the world of accountant and auditor salaries, exploring the factors that influence your earning potential and offering tips to maximize your income in this dynamic field.

Defining the Accountants and Auditors :

Accountants and Auditors ensure the accuracy and transparency of financial records. While their roles often complement each other, there are key distinctions between their functions.

Accountants:

- Financial record keepers, who meticulously record, classify, and analyze financial transactions

- Experts in financial reporting, preparing key statements like balance sheets and income statements

- Specialists in tax preparation and compliance

- Analysts, who examine financial data to identify trends, assess risks, and create budgets

- Internal controls specialists, who implement safeguards to ensure financial data accuracy and security

Auditors:

- Independent reviewers, who objectively examine financial statements to verify accuracy and compliance with standards

- Identify potential errors or fraudulent activities, and assess a company’s true financial health

- Issue opinions on the fairness and accuracy of financial statements, and provide recommendations for improvement

- Provide external assurance to stakeholders like investors and creditors about the reliability of a company’s financial information

- Ensure companies comply with relevant accounting regulations and standards

The key difference is that accountants are typically employed by the company, while auditors act as independent external reviewers of the company’s finances.

- Accountants and Auditors Salary: A Spectrum of Opportunity

- Top paying industries for Accountants and Auditors

- Top paying States for Accountants and Auditors

- Accountants and Auditors Take-Home Pay

- Expenses and Savings Potential

- Beyond the Base Salary

- Factors Affecting Accountants and Auditors Income

- Boosting Accountants and Auditors Salary: Skills and Tips

Accountants and Auditors Salary: A Spectrum of Opportunity

According to the U.S. Bureau of Labor Statistics (May 2023)1 , the annual median salary for Accountants and Auditors is $79,880. Accountants and Auditors earn salaries ranging from $50,440 to $137,280 annually.

This wide range highlights the diverse factors that influence a Accountants and Auditors.

Top 10% earners: Exceed $137,280 annually

Bottom 10% earners: Make less than $50,440 annually

Projected annual median salary for Accountants and Auditors in 2024-2025 (with 2.5% increase) is $81,877.

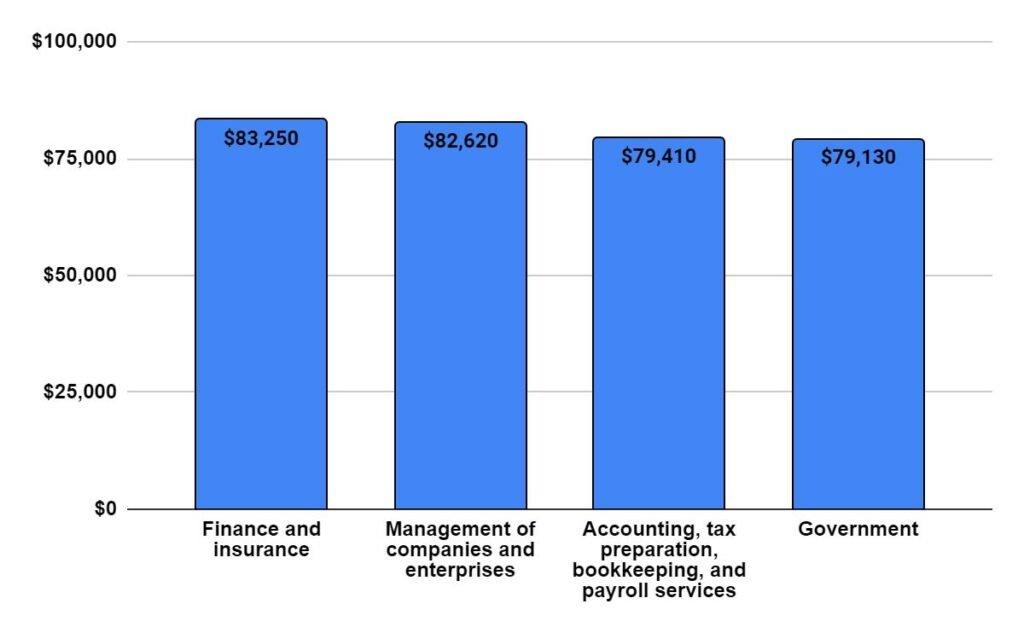

The median annual wages for Accountants and Auditors in the Top industries

Chart 1: Median annual wages for Accountants and Auditors in the top industries (U.S BLS May 20232)

This wide range highlights the diverse factors that influence a Accountants and Auditors income. We will be discussing those factors below.

Top paying industries for Accountants and Auditors

The data reveals that Accountants and Auditors working in Manufacturing and Reproducing Magnetic and Optical Media earn the highest hourly and annual wages, exceeding $133,000 annually (U.S BLS)3.

Other high-paying industries include Web Search Portals, Libraries, Archives, Software Publishers, Media Streaming Distribution Services, Computer and Peripheral Equipment Manufacturing etc.

| Industry | Hourly mean wage | Annual mean wage |

| Manufacturing and Reproducing Magnetic and Optical Media | $ 64.01 | $ 133,140 |

| Web Search Portals, Libraries, Archives, and Other Information Services | $ 63.68 | $ 132,450 |

| Software Publishers | $ 60.70 | $ 126,250 |

| Media Streaming Distribution Services, Social Networks, and Other Media Networks and Content Providers | $ 59.00 | $ 122,720 |

| Computer and Peripheral Equipment Manufacturing | $ 56.77 | $ 118,090 |

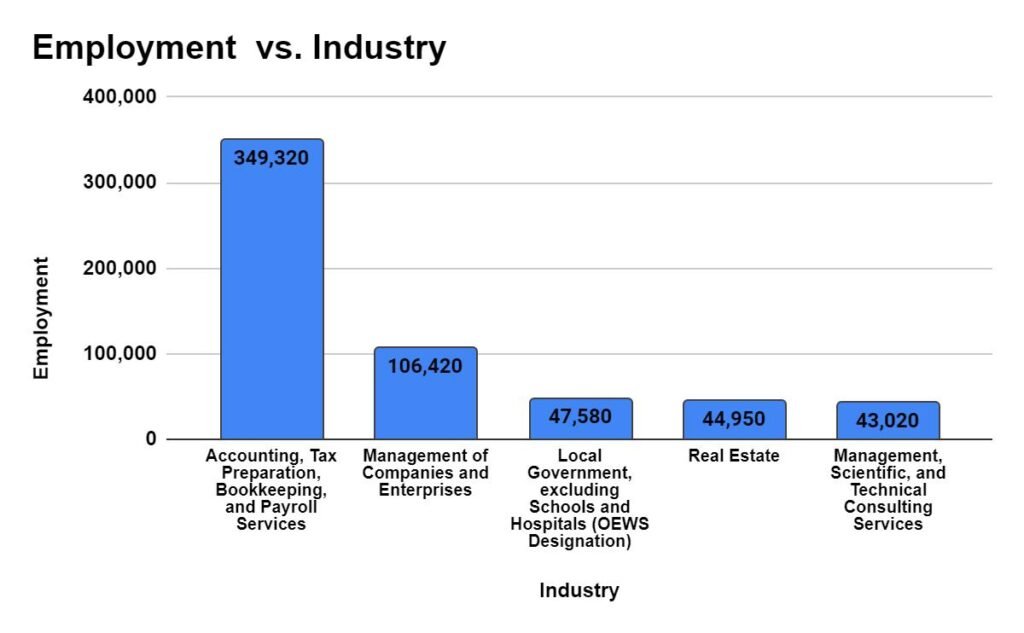

Industry with highest Employment Level for Accountants and Auditors

Most number of Accountants and Auditors are employed in Accounting, Tax Preparation, Bookkeeping, and Payroll Services, followed by Management of Companies and Local Government (Excluding Hospitals & Schools) .

Chart 1: Industry with highest employment level for Accountants and Auditors

Top paying States for Accountants and Auditors

New York leads the pack with the highest annual mean wage for Accountants and Auditors. Following closely are District of Columbia and New Jersey all offering wages exceeding $113,000 annually (U.S BLS)4.

| State | Hourly mean wage | Annual mean wage |

| New York | $ 54.48 | $ 113,310 |

| District of Columbia | $ 54.42 | $ 113,190 |

| New Jersey | $ 53.22 | $ 110,700 |

| California | $ 48.35 | $ 100,560 |

| Massachusetts | $ 47.77 | $ 99,360 |

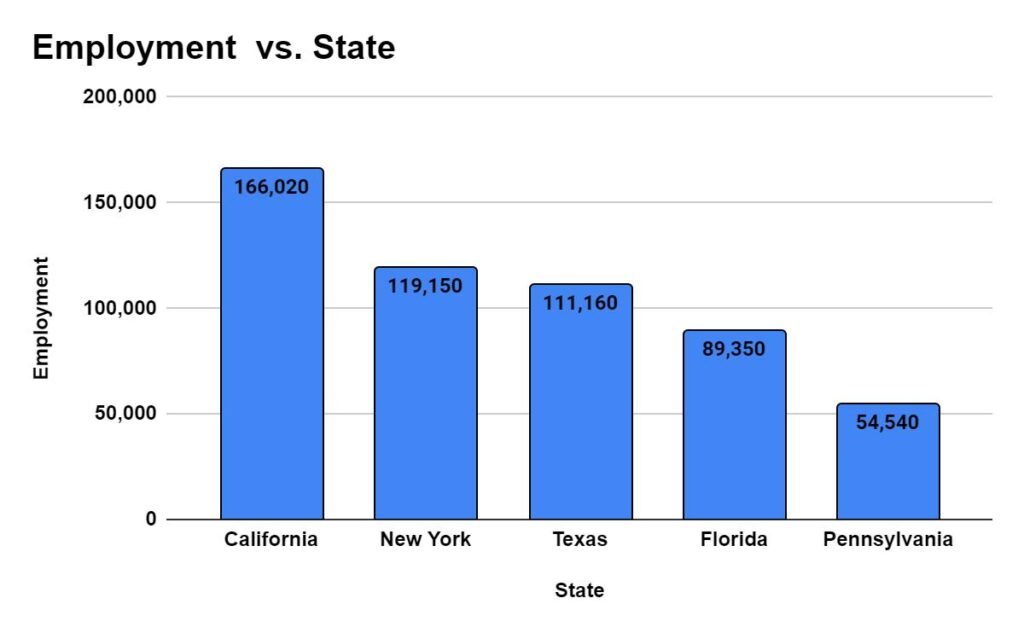

States with the highest employment level for Accountants and Auditors

California leads in providing employment to the Accountants and Auditors, followed by New York and Texas.

Chart 2: States with the highest employment level for Accountants and Auditors

Accountants and Auditors Take-Home Pay

After factoring in federal and state taxes a Accountants and Auditors with a state-wise annual mean salary, would have an estimated net income as follows:

Taxes and take home pay estimate for a single filer

New-York: $113,310 (Annual mean wage) – $23,316 (Estimated income tax) = $89,994 (Estimated take home pay).

California: $100,560 (Annual mean wage) –$19,992 (Estimated income tax) = $80,568 (Estimated take home pay).

Texas: $88,820 (Annual mean wage) – $11,801 (Estimated income tax) = $77,019 (Estimated take home pay).

More taxes can be saved by contributions in IRA, retirement, itemized deduction such as charitable contributions, medical and dental expenses.

Expenses and Savings Potential

The average annual expenses for a single person household in New York are estimated at $46,584 excluding taxes, according to estimates from the Massachusetts Institute of Technology5 . The figures are measured in 2023 inflation-adjusted dollars.

Based on this estimate, a Accountants and Auditors earning the take home pay of $89,994, with basic expenses could potentially save $43,410 annually. It’s important to note that individual expenses can vary significantly depending on lifestyle choices and location.

Savings for Married Couples/Households:

While the data provided doesn’t explicitly detail salary savings for married couples or households, it’s important to consider that combined incomes and potentially shared expenses could significantly increase overall savings potential.

Beyond the Base Salary

Accountants and Auditors salaries often go beyond the base wages. Many organizations offer additional benefits and compensation packages, such as:

Housing stipends: To cover the cost of housing during your assignment.

Meal stipends: To help with daily meals.

Travel allowances: To reimburse travel expenses incurred during relocation.

Health insurance: Comprehensive health insurance coverage for you and your dependents.

Childcare assistance Programs: This can help employees afford childcare, which can be a significant expense.

Paid time off: Vacation days and sick leave.

Life insurance: This benefit provides financial protection for an employees family in the event of their death.

Disability insurance: This benefit provides income to an employee who is unable to work due to a disability.

Continuing education reimbursement: Support for professional development and training.

Retirement savings plans: Employer sponsored plans, like 401(k)s, allow employees to save money for retirement with tax advantages. Employers may also match employee contributions.

Factors Affecting Accountants and Auditors Income

Several factors can affect Accountants and Auditors paycheck:

Experience: As with most professions, experience plays a significant role in determining salary. New Accountants and Auditors typically earn less than their seasoned counterparts.

Specialty: The specific area of accounting or auditing you choose can significantly impact your earning potential. For instance, forensic accountants or Certified Public Accountants (CPAs) specializing in complex tax issues often command higher salaries than general accountants..

Industry: The industry you work in can also play a role. Accountants and auditors working in high-paying sectors like finance, insurance, or oil and gas can expect to earn more than those working in non-profit organizations or government agencies.

Location: Geographic location significantly impacts Accountants and Auditors salaries. States like California, New York, and Texas offer some of the highest pay, while others may offer lower wages.

Public vs. Private Accounting: Public accounting firms that audit companies may offer higher salaries than private companies that handle internal accounting. However, public accounting often requires longer working hours during busy seasons.

Credentials: Obtaining additional certifications like the CPA designation can significantly boost your earning potential. CPAs are highly sought-after professionals and can command higher salaries compared to non-certified accountants.

Boosting Accountants and Auditors Salary: Skills and Tips

So, how can Accountants and Auditors maximize their salary? Here are some tips:

Specialization: Consider specializing in a high-demand area like forensic accounting, international accounting, or IT auditing. Specialization can lead to higher earning potential.

Develop strong communication and interpersonal skills: Effective communication is crucial for success in accounting and auditing. You’ll need to explain complex financial information to clients and colleagues in a clear and concise manner.

Earn your CPA license: Obtaining your CPA license demonstrates expertise and opens doors to higher-paying opportunities.

Negotiate your salary: Don’t be afraid to negotiate your salary during the job offer stage. Research market rates for accountants and auditors with your experience, skills, and certifications in your desired location.

Continue Learning: Stay up-to-date with the latest advancements in accounting standards and regulations. The world of accounting is constantly evolving. Regularly attending continuing education courses ensures you possess the latest knowledge and skills.

Conclusion:

A career in accountancy offers both professional satisfaction and the potential for a high salary. By understanding the various factors that influence salary and carefully managing expenses, Accountants and Auditor scan make informed decisions and pave the way for a rewarding and financially secure career path.

Share this Post

Financial Risk Specialists Salaries USA 2024: States and Industry

Loan Officer Salaries USA 2024: States and Industry

Financial and Investment Analysts Salaries USA, 2024 Trends

Note:

This article provides general information only and should not be considered financial advice: Your individual circumstances and specific job offer details will significantly impact your actual earnings.

Seek professional guidance: Consulting with a financial advisor can provide personalized advice on managing your finances and maximizing your savings potential.

- U.S. Bureau of Labor Statistics: https://www.bls.gov/oes/current/oes132011.htm#st ↩︎

- U.S BLS May 2023: https://www.bls.gov/ooh/business-and-financial/accountants-and-auditors.htm#tab-5 ↩︎

- U.S. Bureau of Labor Statistics: https://www.bls.gov/oes/current/oes132011.htm#st ↩︎

- U.S. Bureau of Labor Statistics: https://www.bls.gov/oes/current/oes132011.htm#st ↩︎

- Massachusetts Institute of Technology: https://livingwage.mit.edu/states/36 ↩︎